MMCIS, a brokerage company, was founded in 2007 and registered in the Seychelles as international commercial firm Tulikuda Consulting Limited. Later it was discovered that the Ukraine-based company operated as a Ponzi scheme.

Photo: MMCIS consulting office in Donetsk, Ukraine.

Originally, the company which claimed proudly to be a broker of the international recognition had its own offices neither in Ukraine nor abroad. The company posted photos of a hotel in Moscow on the official website. A fake person was introduced as a director. They posted photos of their team and one of them belonged to a kindergarten director from Siberia. When the company was keen to attract a wealthy client, they rented an office for an hour to negotiate. All questions were settled by telephone. Founders and management of MMCIS Ponzi scheme

Photo: Konstantin Kondakov.

Interestingly, the person who was the most frequently referred to in the context of MMCIS is not the company’s president but an ordinary trader called Konstantin Kondakov. He was not mentioned in the company’s legal papers but was introduced as a trader. According to the legend, he mastered the art of trading on exchanges for a couple of years, absorbed trading algorithms, and became a leading trader with MMCIS. Kondakov traded transparently and allowed others to watch his work. As a result, he won enormous popularity. Afterward, Kondakov became an MMCIS analyst and entered a rating of MMCIS traders.

Photo: Alexander Volkov

Alexander Volkov, Kondakov’s buddy, owned quite a lot of domains with the MMCIS name. Besides, Volkov is a founder of several software development firms. One of them is Internet Global Technology which shares were inflated in value on Ukraine’s exchange. MMCIS called on people to invest in these securities.

Photo: Anton Savchenko.

Anton Savchenko is a founder of Konstantin Kondakov’s charity. The MMCIS trademark was registered in his name. He was also in charge of accepting money from investors. Moreover, he acted as director and chief accountant of Alexander Volkov’s charity and his own Anticorruption firm. Dmitriy Cherniy is another co-founder of the MMCIS Ponzi scheme and MillTrade. The hosting provider which held MMCIS servers was registered in his name. Nowadays, he helps Kondakov embark on the IT market. Besides, Cherniy owns Epsy Soft in Ukraine. Vitaliy Sotula also took part in Ponzi schemes. He acted on behalf of MMCIS in trials. Vitaliy Sotula established LEONIS, a law firm in Kyiv. He is also a director of IT Outsourcing, a Ukraine-based company and an acting director of Anticorruption non-commercial organization. Dmitriy Garkusha is a co-founder of the Ponzi scheme. When the project had just started, MMCIS in Ukraine was registered in his name. Yuliya Barabash acted as an executive director of MMCIS in Ukraine and CEO of Forex MMCIS Group. Anastasiya Teplygina was a development director of MMCIS in Russia. Anatoliy Kashkin was put in charge of MMCIS Investments in Ukraine. Ekaterina Makarevitch (Tudos) used to be the right-hand person of Vitaliy Sotula. A few companies within MMCIS were registered in her name, in particular OOO Profit Consul. Arvid Orro is a founder of MillTrade. Natalia Kolesnik was a director of Kondakov’s charity. Yanina Praschur was a founder of OOO Big Limited, one of the firms within MMCIS in Ukraine. Roman Komysa is the latest president of MMCIS and a founder of OOO MillTrade. The list of the above-mentioned people is not complete, but it gives the idea of most executives in the notorious Ponzi scheme. To gain more insights about this large-scale fraud we should consider its other activities. MMCIS promo campaign After Kondakov had become an MMCIS brand ambassador, the broker launched an aggressive advertising campaign. The large flow of advertisement flooded Ukraine’s media and also spread outside the country. Billboards and the company’s logo were seen in Russia and other CIS countries. Praising materials about the broker were released in the media and negative articles were replaced with adverts for a reward. The PR campaign achieved perfection. The company created analytical web resources where bogus clients applauded the broker’s traders for their expertise.

Photo: MMCIS logo at the top of the Dnipro hotel on the European square in the center of Kyiv.

Interestingly, being neither a major bank, nor a successful finance company, MMCIS allocated a generous budget for its PR campaign equal to large banks. The broker could afford such expenses as its operation rested on the principle of attracting clients at any cost until the Ponzi scheme brings money to its founders. No wonder, with its lavish advertising budget the MMCIS brand popped up everywhere. The broker’s logo was printed on race cars at popular tournaments. Well-known politicians held election campaigns with MMCIS support. Even celebrities took part in the broker’s advertisement. Among them were such big names in the Russian show business as Leonid Yarmolnik, Barbara Brylska, Anfisa Chekhova, Aleksander Buynov, Boris Burda, and Aleksey Buldakov. Obviously, these famous “investors” did not know about the Ponzi scheme. They just agreed to be filmed for a good award but were unaware that they were helping fraudsters win favor with Russian clients. One more interesting point is a contest arranged by MMCIS called Snow-white Mazda. The company claimed it would raffle off generous prizes – a few posh cars. However referring to Ukraine’s traffic police, one white Mazda 3 was registered in the name of Aleksander Volkov and the second car belonged to Vitaliy Sotula.

Photo: one of those snow-white cars which was allegedly raffled off among MMCIS clients.

MMCIS did not exhaust its PR techniques. Another example of the peculiar marketing is the promo campaign with the title: Have tattoo of MMCIS and receive prize money! The promo was launched in May 2014. Participants who had the MMCIS logo tattooed were offered a great reward - $3,000!

Photo: MMCIS paid a generous reward of $3,000 for its brand name tattooed.

Benefitting from its promo campaign, MMCIS amassed huge funds from the population as the company promised over 100% of an annual interest rate. MMCIS focused on people without trading experience on Forex. According to different sources, the company defrauded people of $50-300 million for several years. Most of this money was spent on advertisement which used to be installed everywhere as the company spared no expense.

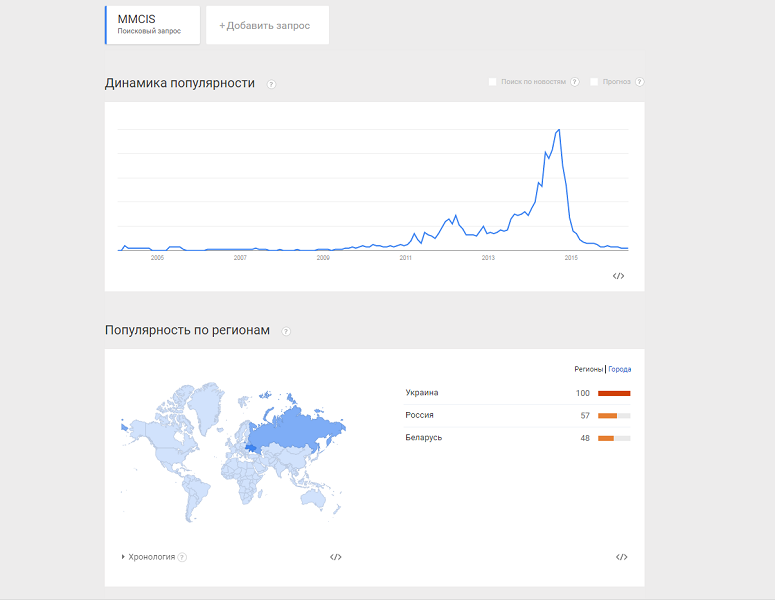

Photo: MMCIS popularity in Ukraine, Russia, and Belarus in 2005-2015 according to GoogleTrend.

How did they trick? In fact, the money was not used for trading on successful accounts. Instead of actual management of entrusted funds, they provided clients with fake charts of profitable trading, thus attracting more and more naïve investors. Like in all Ponzi schemes, the affiliate program was assigned the key part. Investors were eager to earn extra profits and attracted new clients, enhancing the company’s reputation. Later, MMCIS offered a new service: IndexTOP20. Clients invested in 20 the most successful traders at the same time who displayed exceptional trading skills on Forex. The company compiled a rating of successful traders who made steady profits and managed investors’ funds. Kondakov was also introduced as an efficient trader.

Photo: the list of “successful” bogus traders who were promoted by MMCIS as trustees of clients’ investments.

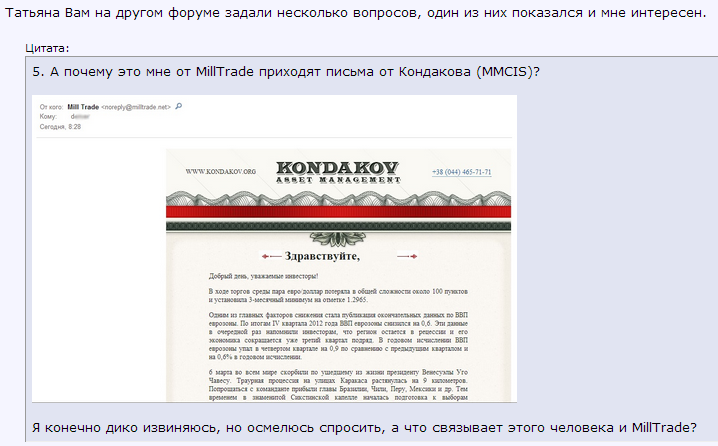

In 2012, the company encountered the first trouble. The media reported on swindlers from Melitopol. So the image of a prosperous financial company was obviously spoilt. MMCIS invented a great way out: they played a trick of selling the MMCIS trademark at 100 million Hryvnias ($12.5 million). No doubt it was a lie to calm down potential clients. In fact, Savtchenko sold the MMCIS trademark, granting the right to settle the payment within three years. Interestingly, assets of MMCIS Forex Group swelled by 100 million Hryvnias immediately. After 2012, MMCIS managed to sort the mess out and again picked up steam. Eventually, the fraud collapsed in autumn 2014. In August – September 2014, the media reported on numerous cases of delayed repayments to credulous investors by MMCIS, the successful financial company. In October 2014, Kondakov, the founder of the Ponzi scheme, unexpectedly left MMCIS. The most successful trader drained his account in a public move and announced he would quit the company. Everything was planned in advance. Roman Komysa was claimed to be responsible for such developments. On December 12, 2014 a criminal case was filed against Forex MMCIS Group in Moscow. Interestingly, the investigation in Ukraine was surprisingly suspended and Konstantin Kondakov won all trials on his illegal financial activities in Ukraine. Interestingly, the lawsuit against MMCIS has not been launched yet in Russia, though the losses incurred by the scam amount to several million dollars. MillTrade The MillTrade broker emerged in the financial market in 2013 and rapidly gained popularity. A striking resemblance between MMCIS and MillTrade was recognized easily. No wonder both Ponzi schemes were founded by the same people. Clients received emails from MillTrade on behalf of Kondakov.

Photo: some clients received emails signed by Kondakov from MillTrade’s electronic address. This proves an evident connection between MillTrade and MMCIS.

The company put a stress on a simplified market entry compared to traditional investing in PAMM accounts. All investors were required to do is deposit their funds to the company’s account and wait for a monthly report with a statement how much money clients earned with MillTrade. In practice, there were neither PAMM accounts nor managing traders. Investors just injected their money into MillTrade and believed that they were investing in the top seven traders.

Photo: Golden seven were promoted on the MillTrade website. So clients were called on to invest their money.

The Golden seven program was a portfolio consisting of accounts of the seven best traders: Vadim Idrisov, Mikhail Fyodorov, Viktor Gaiduk, Yevgeniy Ponizovskiy, Vyacheslav Belousov, Erick Nyman, and Gerardo Porras. The most information in the internet can be found about Erick Nyman compared to the rest of the traders. He has written a lot of Forex-related articles for the Forbes. Eventually, MMCIS announced a merger deal and acquired the notorious MillTrade broker. Citing Roman Komysa, MillTrade was not an affiliate company. New project – new Ponzi scheme Nevertheless, Kondakov & Co. was not going to give up. Ambitious internet entrepreneurs created a new project: safe internet messenger called DefTalk (DefCom company). DefCom was registered in the name of Dmitriy Cherniy who has been mentioned above. DefCom operated on exactly the same principles, in particular assets were artificially bloated. The history repeated itself like it was with Forex MMCIS Group when Savtchenko sold himself the MMCIS brand name for 100 million Hryvnias. Besides, in December 2015 Kondakov posted a statement on his account in social networks. He announced that the new project would be launched soon to revive MMCIS. Interestingly, Kondakov was not going to exploit the concept of a Ponzi scheme. The thing is that Kondakov needed investors and almost $2 million urgently. Those ones who believe enticing pledges to gain huge returns have to think carefully. Does it really make sense to invest your money in a dubious firm? Such a promising project is likely to operate as an odious Ponzi scheme. The opinion of the review`s author is private and not obligated to reflect the position of the resource. If you have any remarks and suggestions on new articles please contact us via this form.

Añadir comentario

¿Otros brókers de interés?

430

430

0

0

Looking back to the time when MMCIS was very active in promoting its services, everyone was really interested to open an account. In fact, I also registered to the broker and invested $500. This amount was never return to me because the broker also shut down after several months.

MMCIS exhausted all marketing opportunities that is why it became popular in our country pretty quickly. I know a lot of people who have invested on this broker and that includes myself. When the broker suddenly disappeared, we were all devastated and reality hit us. We had been deceived and we lost our money permanently.

There was nothing I could do about what I experienced at MMCIS. The broker offered overwhelming services and it created an illusion of progress in my investment. Unfortunately, we were all deceived and our funds were taken away by its owners.

We cannot deny how much influence MMCIS had in the financial market. It really made a name for itself and it was very popular for a while. It is no wonder they were able to attract tons of investors.

MMCIS really went all out on their marketing campaigns. I opened an account with the broker because I was intrigued. I wanted to experience their services and have the opportunity to earn well. Unfortunately, this did not end well. I only lost the money I invested and got banned by the company because I tried to withdraw my remaining funds.

I can't believe I let MMCIS play with me like this. I was so hooked into their lucrative offers. In fact, it was overwhelming and all I could think of was that I want to invest with them and earn huge amounts of profits.

Who wouldn't want to open an account at MMCIS when the broker kept promoting their lucrative services. Of course, since I wanted to earn so bad, I decided to invest with the broker. Never expected that a company as publicized as them would turn out to be a fraud.

I was tempted to open an account at MMCIS because of their generous rewards and bonuses. There was no other broker that would offer a lot of rewards and I think I know why now. No other broker offers this because they are not a fraud like MMCIS.

The main reason I opened an account at MMCIS was their offered bonus. I was told to receive a hundred percent bonus if I deposit at least a thousand dollars. I saw it as a great opportunity as I may be able to grow my funds through trading. But then after depositing the money, my trading account became inaccessible and I could not contact the company anymore.

MMCIS appeared reputable. It was hard to miss this broker because their name was everywhere. And they had highly lucrative trading conditions. I guess this is why many of us took the risk and invested in them. Sadly, it was a short moment of bliss and we were all faced with reality when the broker fled.

Show more

Añadir comentario

|

Brokers Reviews

BRÓKER RECOMENDADO

CORREDOR FOREX №1 EN ASIA

Bono del 30% por CADA depósito

Apalancamiento 1:1000 Forex charts and quotes

|

MMCIS terminates on November 21, 2014