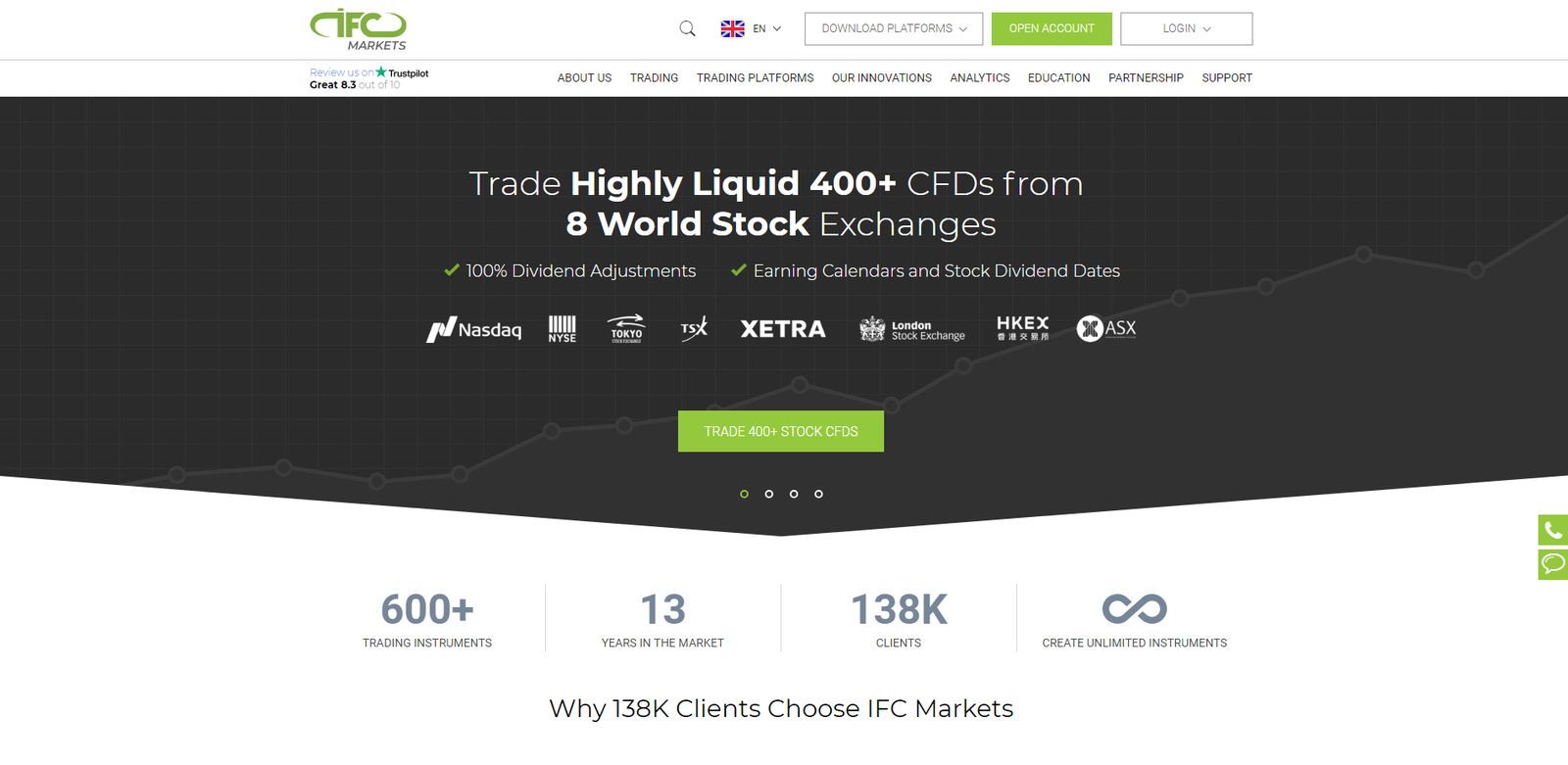

On-line since: About the company: IFC Markets is a leading brokerage company offering a wide range of trading instruments: currency pairs, CFDs on indices, commodities, and precious metals, as well as unique personalized instruments on two trading platforms. Company’s history IFC Markets is a trade name of IFCMARKETS. CORP. registered in the British Virgin Islands (BVI) and licensed by the Financial Services Commission (FSC). The broker is part of IFCM Group that has been developing and implementing new effective projects in the field of financial technology for more than 10 years. The group of companies also includes software developers NetTradeX Corp and IFCM Cyprus Ltd (formerly known as Infin Markets Limited) licensed by the Cyprus Securities and Exchange Commission (CySEC). Security of funds As we have already mentioned, IFC Markets Ltd is regulated by the Financial Services Commission of the British Virgin Islands. It has a Category 2 Global Business License. It permits the broker to arrange investment deals. Companies undergo rigorous checks by the FCS to obtain such a license. Despite offering a regulated status, the FSC allows companies to be located abroad. Besides, BVI-registered financial services providers are not compelled to comply with the requirements that brokers in Cyprus and the UK usually impose. Generally, we advise traders to choose among UK, Swiss, or other well-regulated brokers, where your funds will be protected. However, if you are looking for an offshore broker for some reasons, then IFC Markets is a reliable choice. The firm is part of an international group of companies. It has a 10-year experience, and offers quite good trading conditions, as well as innovative technologies and several unique functions. Trading conditions IFC Markets has two types of accounts on two different trading platforms. Both accounts provide the same tight fixed spreads, instant execution, and commission-free trading. Accounts for beginners offer not only micro lots but also the opportunity to trade in 100 units of a given currency. In addition, swap-free (Islamic) accounts are available for all types of accounts by request from clients who are not willing to earn interest for religious reasons. The VIP status is automatically assigned to accounts with a trading deposit from $50,000. Holders of such accounts may benefit from flexible trading conditions, personal account manager guidance, and assistance provided by an analyst in the creation of an investment portfolio using the GeWorko method. Minimum deposit A minimum initial deposit for IFC Markets’ clients is only $1 which is quite a low figure. However, at least $1,000 is required to open a standard account. Spreads and commissions IFC Markets provides fixed spreads amounting to 1.8 pips on EUR/USD which is a quite low figure, as, in general, fixed spreads are higher than variable ones. Like most brokers with fixed spread, this one charges no commission and earns only on the spread. Leverage The maximum leverage offered by IFC Markets is high and reaches 1:400. However, many other offshore brokers provide similar or higher leverage. We would like to remind you that higher leverage poses a greater risk. Trading platform IFC Markets’ clients can choose between two trading platforms: MetaTrader 4 (MT4) and the company’s own NetTradeX. Now it is also possible to trade on MetaTrader 5 with floating spreads (in a demo version). NetTradeX is a trading analytical platform launched back in 2006. It offers a wide range of currency pairs, indices, and CFDs on stock indices and commodities. It is available for desktop devices with Windows operating system, as well as for mobile devices with iOS, Android, and Windows Mobile operating systems. In addition to standard trading instruments, this platform provides the unique option of trading in personal composite instruments (PCI). Traders can create PCI on their own using the GeWorko method which is based on the Forex concept. It means that one financial asset is quoted by another. PCI includes new cross rates, correlations between various assets, currency indices, stock portfolios, etc. Along with NetTradeX, IFC Markets also supports MetaTrader 4 (MT4), the world’s most widely used forex trading platform. It is available for the desktop, web and mobile versions. Most experienced traders prefer MT4 because it is equipped with an advanced charting package, a number of technical indicators, Expert Advisors (EA), and extensive back-testing environment. Moreover, trading signals service is available on the MT4 only with this broker. In June 2017, the broker also launched trading on the MT4's successor - the MetaTrader 5. Special services We would also like to note that IFC Markets offers up to 7 percent annual interest on free margin. Support service IFC Markets provides highly qualified customer support in 18 languages. Traders can contact IFC Markets via email, chat, a callback, Skype, phone, WhatsApp, and Telegram. The support service operates 24 hours a day, five days a week. The Frequently Asked Questions section is divided into four groups. If you cannot find the necessary information, you may contact support service’s managers by any of the above methods of communication. Payment options IFC Markets’ clients can choose from a wide range of payment options: wire transfers, bank cards, Skrill, OKPAY, Webmoney, Neteller, Qiwi, China UnionPay, and Western Union. The broker accepts USD, EUR, and JPY. Feedback Traders complain about difficulties in contacting the support service. Advantages:

Disadvantages:

4/10

(votes 1870)

Add comment

Interested in other brokers?

45

45

0

0

The platform experiences minor glitches from time to time, but otherwise everything seems to be fine.

Like the flexibility of multiple trading platforms.

In my opinion, IFC Markets is one of the most stable brokers in the market.

Good Broker - fast withdrawals, regular technical analysis, customer focus, low spreads

IFC is an awful broker, As I have had a very painful trading experience on the MT4 platform, especially during the news time. My position is slippage on every news publish time. In addition, frequently hold it at a high level until a long time after the trade. Anyway, I decided to leave IFC broker and move forward.

Truly good platform for a beginner

I've been testing this broker on spreads and commissions for a while, wouldn't say they have lowest spreads or commissions, but when you add all the fees comes at a pretty price.

I like to trade with IFC Markets because they have an affordable minimum deposit. I opened an account at IFC Markets and started to trade one year ago. They have good trading conditions such as fixed spreads, instant order executions, and no commission for trading. I did withdrawal many times, and it was always successful within 6 hours or a day after sending the withdrawal request via Skrill. So I'm totally satisfied to trade with IFC Markets.

I would not recommend IFC to anyone, The order execution is very slow during news events. I also had a hard time exiting trades because of constant requites even if price bounces up and down. I requested for withdrawal of $370 about 21 days and until today my withdraw is still in queue! I'm trying to reach their customer support but to no avail.

With the low initial deposit requirement at IFC, I was able to start my own trading account. It took a while for me to adjust but when I did, I was able to make remarkable trades and that is possible because of the stable platform of the broker.

Show more

Add comment

|

Brokers Reviews

RECOMMENDED BROKER

Forex charts and quotes

|

IFC review