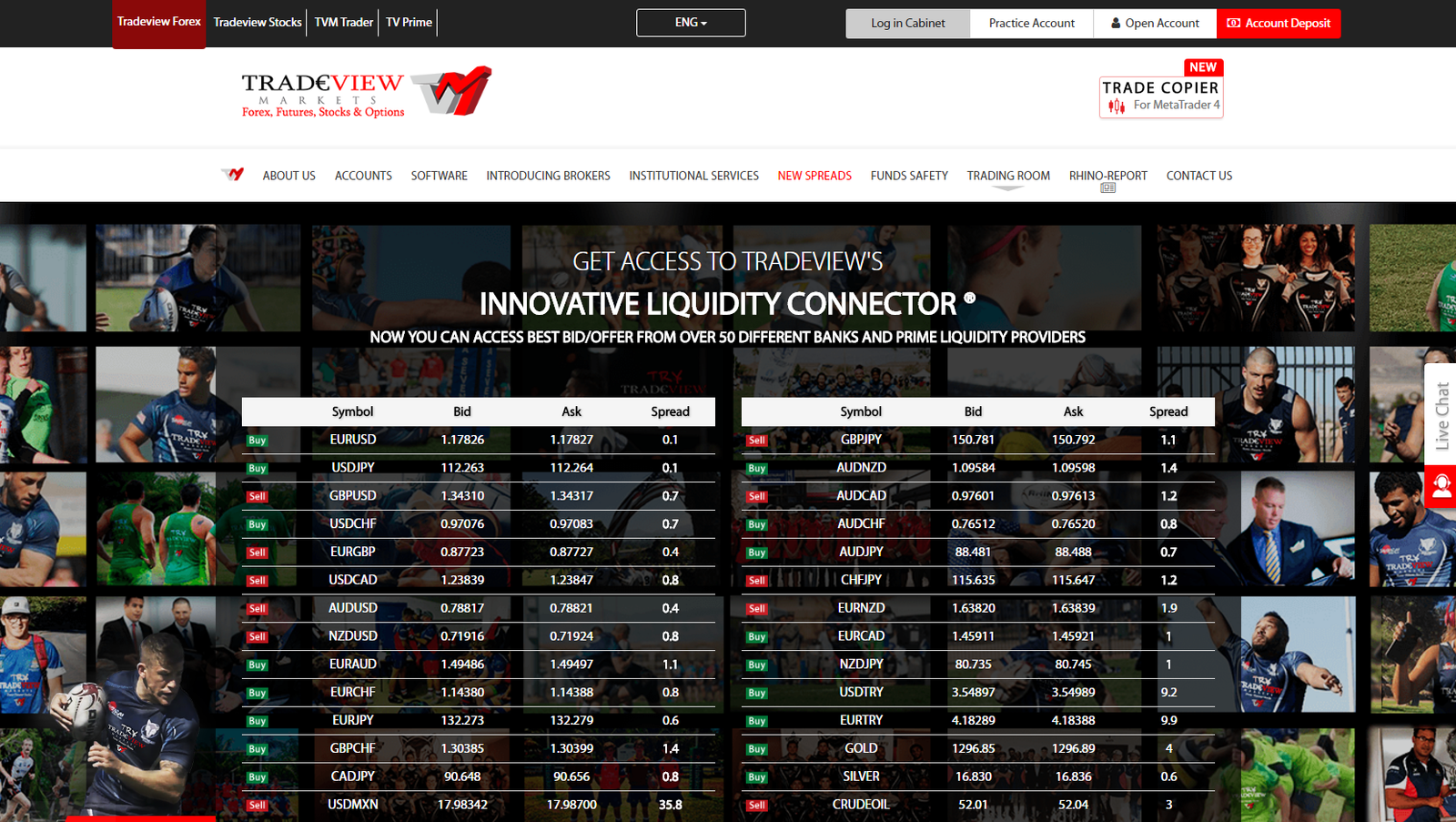

On-line since: About the company: Founded back in 2004, Tradeview Markets (formerly Tradeview Forex) is a brokerage offering more than 40 financial instruments for three trading platforms. The brand is owned by Tradeview Ltd., which is headquartered in the Cayman Islands and licensed by the Cayman Islands Monetary Authority (CIMA). About company. Funds security Offshore locations are known for their light-touch regulation. They are attractive to start-ups as it is relatively easy and cost-effective to launch a brokerage business there. Exemption from all local taxes and stamp duties, non-disclosure and minimum capital requirements are among the advantages of forex companies in the Cayman Islands. Regulation of the CIMA cannot be compared to the supervision by US or UK financial regulators. Still, forex brokers licensed in the Cayman Islands are required to hold at least $100,000 worth of net tangible assets as well as to adhere to a certain reporting schedule and regularly submit financial statements by an independent auditor. If you want to invest a large amount of money, we recommend that you choose a broker belonging to another jurisdiction. Check out other forex brokers in our ranking. Trading conditions Clients of Tradeview Markets are offered a choice between two account types: commission-free X Leverage account with higher leverage and ECN Innovated Liquidity Connector account, providing tighter spreads and involving commission. Both account types offer trading micro lots. Minimum initial deposit To open an account with Tradeview Markets, you need to deposit at least $100. This is a reasonable minimum initial deposit requirement. But we cannot but mention brokers that require at least $1 to start trading. Spreads and commissions Being an ECN broker, Tradeview Markets has competitive spreads for commission-free accounts, which average 0.9 pips on EUR/USD. Average spreads for an ECN account are 0.2 pips on EUR/USD, but it charges commission of $2.50, so trading costs for this account type total about 0.7 pips. For comparison, some brokers offer variable spreads which average 1.2 pips on EUR/USD for commission-free accounts and spreads starting from 0.5 pips for accounts with commission ($3.86 per lot). Leverage The broker offers leverage up to 1:400, which is an average ratio in the market. Most offshore brokers provide similar maximum leverage levels. Trading platforms Clients of Tradeview Markets can choose between three trading platforms: MetaTrader 4 (MT4), cTrader and Currenex. Currenex is a trading platform for experienced traders. It focuses on buying and selling via ECN and features a variety of order types and execution algorithms as well as advanced reporting tools. The platform is Java technology-based, requiring no installation. In 2016, Tradeview Markets included cTrader in its line of platforms. Developed by Spotware, cTrader is a true ECN platform. It provides traders with a deep pool of liquidity providers, as well as an assortment of cutting-edge tools, such as timeframe charts, 30 technical indicators, trend lines, Fibonacci levels, support and resistance lines, channels, market depth, etc. Like most brokers, it also supports MT4, which is popular among experienced traders for its various technical indicators, extensive testing environment, an extended set of charts and a wide range of experts advisors (EAs), allowing clients to fully automate their trades. In addition, the broker provides the MAM account options. A simple, fast, effective and reliable MetaTrader4 plugin, Multi Account Manager is designed to simultaneously manage multiple trading accounts. Campaigns At the moment, the broker offers a 100% bonus for deposits of up to $500. What is more, clients can open Innovated Liquidity Connector account for just $1,000, instead of $25,000. Support service The company has its offices in the Cayman Islands, the US, Colombia, Peru, Spain, and the United Kingdom. You can contact the support team via live chat, by phone or email. Payment options Payment methods offered by TradeView Markets include wire transfer, credit cards, e-wallets, such as Neteller, Skrill and Uphold. In fact, TradeView is the first broker to integrate the services of Uphold financial company. Advantages:

Disadvantages:

1/10

(votes 2186)

Add comment

Interested in other brokers?

8

8

0

0

Tradeview Markets already boasts many advantages, such as low spreads. They also offer a variety of trading platforms and offer numerous attractive promotions. I'm sure more and more people are trusting this broker.

Tradeview Markets has many advantages and benefits. Some of the advantages that I have felt are guaranteed account security, low spread, commission-free, many promos, very fast service, sophisticated and effective trading platform. There are still many more that I can feel if I continue to join them. Hopefully, the benefits and success are with me.

I have tried Tradeview Markets and I am not pleased with them. During the last news time, I experienced a fake slippage of 71 pips on the USD/CAD pair on their MT4 platform which caused my profitable opened positions closed with negative balance and I lost about $558. Even my SL did not execute. Now slippage is happening so regularly. But when I called them, they said they doing nothing and were not responsible. What kind of broker is this

I have profitable trading experience on the Tradeview’s platform, really I can find a clear charting tool and live price quote on their MT4 platform and my orders execute instantly. So I am comfortable trading with Tradeview. Till now I have earned $750. which is able to withdraw via Skrill account within four hours. So I say Tradeview is a reliable broker.

I was convinced to open an account with them because as a beginner, I saw that they offered services favorable even for newbies. Trading with this broker is very easy. However, the only problem is that it is not regulated.

I have been trading with TradeView Markets for five months. Lately, I have always faced negative slippage in my trading. Customer support is getting ignorant, and sometimes hard to call them. Spreads can get higher, and they charge a big commission, which is it's not reasonable. They have slow executions and high spreads. I don't feel satisfied with their service, and trading with them is not profitable anymore. I'm looking for another broker who can provide excellent service for me and beneficial.

I am completely satisfied with my cooperation with Tradeview Markets. I opened my live with them account since November. I am using their Currenex platform and never had any objection about their execution and the spreads are fine in view of the commissions I paid to other brokers who offer tighter spreads. I observe that in volatile market they do not make delay in trades execution. Customer support service is just great! I advise you to test Tradeview Markets broker and to convince yourself about the facts I have stated here.

I used my credit card to fund my trading account at Tradeview Markets. The process was fast whenever I deposit money, but now that I am trying to withdraw my profits, the process is taking too long. I have been waiting for week now but the money is still not being transferred. The broker just keeps on telling me to wait for it, so I guess I have no choice but just to wait.

Show more

Add comment

|

Brokers Reviews

RECOMMENDED BROKER

Forex charts and quotes

|

Tradeview Markets review